Steps that can help you face tax audit in united states?

There are many ways that an individual can take to face tax audit in US. The very first thing is to make habit of keeping records as it can easily help you to calculate your tax return. Other than this there are several other ways for preparing yourself for a tax audit. The underlying article mainly focuses on those ways.

Taxes are an unpleasant reality, and like death, howsoever one may try, one cannot avoid them. Most of us know this and are ready to pay our taxes. Yet, few of us would be very willing to subject ourselves to the scrutiny of IRS, even when we have paid our taxes in full.

Preparing for an audit by the IRS calls for some efforts and those efforts need to begin now, not after you receive a notice from the IRS. The first thing you need is to know what happens in an audit, the next is to understand what you need to do to have a smooth audit, and last is to execute what is required.

There are primarily three types of audit undertaken by the IRS.

(i) CORRESPONDENCE AUDIT - For a single issue that can be resolved easily by providing a particular detail, there may be only a 'correspondence audit' wherein the tax examiner of the IRS Compliance center asks for a particular detail or explanation by mail, and after receiving it from the taxpayer, resolves the issue by either dropping the matter, or rejecting it and asking the taxpayer to pay further taxes.

(ii) OFFICE AUDIT - In other cases requiring a detailed interaction, the taxpayer may be called to the local area office of the IRS for what is termed an 'office audit'. The notice for such audit asks for an interview at a scheduled date and hour in a particular office. The taxpayer can comply with it either by attending the interview personally or through an authorised representative.

Usually, such audit is limited to certain specific issues, and the whole information of taxpayer's accounting is not scrutinised. The scope of Office audit is limited. Most office audits pertain to annual income of less than $100,000

(iii) FIELD AUDIT - If the matter is more severe than can be taken care of by an office audit, then the IRS may conduct a 'field audit' at the business premises of the taxpayer. Usually, when there are multiple issues selected for verification, the tax auditors, consisting of 'Revenue agents' of the IRS visit the tax-payer at his place of work where they interview the taxpayer and verify the details stated in his return with documents, activities and other material available.

The first thing that the taxpayer needs to be conversant with is her own rights as a taxpayer. Go through the 'Publication 1' of IRS tiled ‘Your rights as a taxpayer’ which provides all the details about it. You can order this by calling the IRS at 1-800-829-1040 or download it from the official website of IRS. Reading it will help you realise what you are supposed to comply with and what you are not obligated to do, even if so requested by a Revenue Agent.

Second and perhaps the most important thing to understand is the fact that when you are face to face with IRS agents, you need to carefully balance the need for maintaining cooperation and a good rapport, with the precaution of not volunteering any information or details yourself. Thus, be polite, try to cooperate as much as you can when requested, but also remember that you are not expected to volunteer any information on your own.

Third, it is also important to remember that IRS agents are doing their job that we, the citizens only have assigned it to them. Even if they are taking a stand that you do not agree with, remember that there are several layers of appellate authorities above that agent, and there is no need to panic if you think the agent is acting smart or being too unreasonable. Losing your temper or projecting hostility will only annoy him further, and won't help your cause in any way.

Lastly, you must understand that the tax code requires the taxpayer to substantiate the claim for deductions made by your. So, unless you support all claims of deductions on account of expenses, donations or contributions, you will have to substantiate your claim with supporting evidence, documents or explanation. The earlier and faster you are able to do that, the easier it will be for both you and the agents doing the audit. However, also remember that for every audit, there is a time budget allocated, and if you do things too fast, it may only leave the agent with enough time to ask for more!

Understand what is happening, fully cooperate, but take your time wherever you can.

The IRS may not be the most effective detective agency in the world, but they do tap a lot of data and carefully do their homework before they identify a target for audit. So, to avoid embarrassment, it may be prudent to go with the traditional and time tested wisdom- honesty is the best policy. If you are not thinking of avoiding your taxes, there is practically very little that you need to worry in a business audit.

However, honesty alone may not help you much if your accounts and records are in a mess, because in that case, even if you have genuinely claimed an expense to which you are fully entitled, you will not be able to locate the supporting documents and evidence that will substantiate your claim. If you do not keep your records and papers properly, you can still have problems during an audit.

The tax code in the United States runs in some 6000 pages, and the accounting standards and their nuances may not be your cup of tea, unless you have had some training in these matters. So, if you can afford to do so, then do take the help of a professional accountant. Develop a habit of preserving your records - it may be the difference between a smooth audit and a painful one.

Many audits focus primarily on the deductions that you have claimed. So make sure that you are claiming your deductions as per the law. Even if you are not a legal expert, you can find most of the basic facts by visiting the IRS site and looking for information related to the deduction you wish to claim. Particularly important in this regard are the deductions for expenses that may be partly personal and partly pertaining to business. It may be worth the effort to have a look at Section 274, which provides as to which of these expenses are allowable, up to what limits and subject to which conditions. Similarly deduction claims made for donations and contributions also deserve a look at the relevant tax code.

In fact, if you take a look at them before you indulge in that expenditure, it will help you in planning your tax management. Remember that it is perfectly legal to arrange your affairs in a manner that will minimise your tax liability.

Once you receive a notice for an audit, find out which type of audit you are being subjected to. If it is a correspondence audit, providing the documents and explanations that are called for may be all that you have to do.

If it is an office audit, try to call and find out what information is required, how much is the tax implication that is the subject of audit and how complex are the issues involved. Depending on these, take a decision as to whether you would like to go yourself or send an attorney as your representative. Once you know as to what issues are the subject matter of audit, try to locate and keep ready all the records pertaining to them. In case there are any complex legal issues involved, you may want to seek expert opinion on those matters before you face the agent.

If you are being subjected to a field audit, then preferably have a practitioner represent you. You should ask for the field audit to be held at the office of the practitioner, as it will help you in avoiding the disturbance at your work-place, even if it means to have a constant to and fro movement of records between your workplace and that of your attorney. It may also prevent the Revenue agent from understanding your business practices. When asked for an explanation, take your time, and while defending yourself, avoid all falsehood.

While preparing for the audit, if you realise that you have made an error, be ready to accept it when the matter comes during the audit. When you are at fault, there is no point at all in prolonging the agony and wasting everyone's time, particularly your own.

A business audit is not always a bad thing. Actually, it is also an opportunity for you to review your record keeping and accounting practices and improve upon them. It is also a time to get conversant with the law and practices of IRS. Taxes, like death, are unavoidable and there is no point whatsoever losing your sleep worrying about either of them.

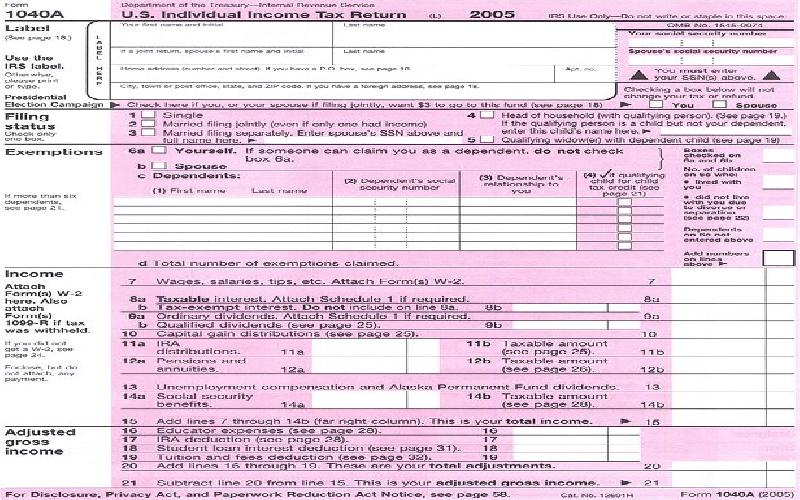

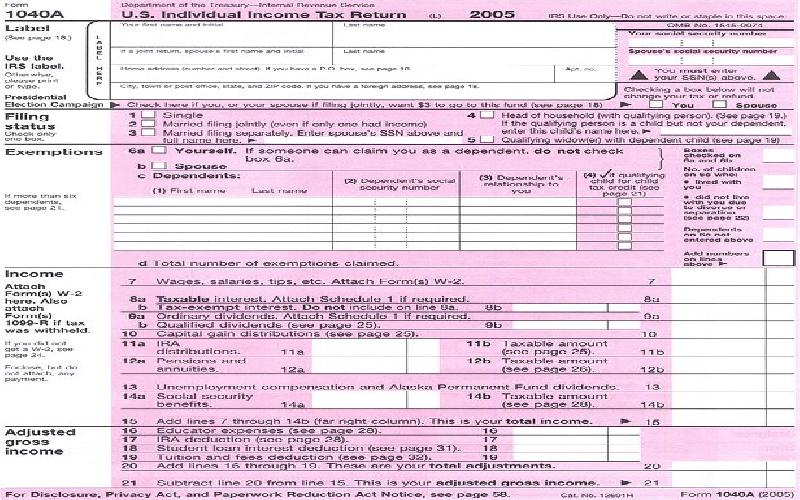

People generally are in a dilemma as to which income tax return shall be applicable to them that they have to file with the income tax department. Here in this article the applicability is clarified making it easy for all to select the apt income tax return for them..

Continued quantitative easing, with little positive outcomes to account for the expansions of liquidity during the last decade can make all stakeholders uncomfortable. In particular, they raise significant questions about our comfort level with the Keynesian economic principles that advocate such expansion.

.Man power planning being also called as human resource planning is of great significance for business organizations. It’s a process of acquiring, developing, allocating and utilizing human resources.